The Most Undervalued REIT in Europe: Trading at 3.2x P/E with 78% Upside

Why this €106M Athens-focused real estate trust offers exceptional value in Europe's fastest-growing commercial property market

Real Estate Investment Trust Analysis: BriQ Properties REIC

Today, I am introducing you to a company that has been delivering consistent returns in the rapidly expanding Greek commercial real estate market, with an attractive 5.27% dividend yield and an impressive 23.06% return on equity. This company operates in the strategic Greek REIT sector with a focus on high-quality commercial properties in prime Athen’s locations.

You might wonder why this Greek-focused real estate investment trust deserves your attention. Unlike many European REITs trading at premium valuations, this company combines attractive dividend income with solid fundamentals, including a reasonable 3.2 P/E ratio that significantly undervalues the company compared to its international REIT peers, and access to one of Europe's fastest-growing commercial real estate markets.

Several long-term trends support the company. The Greek real estate market is experiencing a renaissance, with commercial properties in Athens seeing price increases of 47.3% since 2019. Additionally, the country's Golden Visa program continues to drive international investment, while major infrastructure projects like The Ellinikon development are transforming the commercial landscape.

The company is also positioned to benefit from Greece's economic recovery. With GDP growth projected at 2.3% for 2025 and continued expansion of the tourism and logistics sectors, there's substantial tailwind for commercial real estate demand.

An investment thesis does not have to be complicated.

Let me introduce you to:

BriQ Properties Real Estate Investment Company -- Athens Stock Exchange: BRIQ.AT

Description

The Kallithea, Greece-headquartered BriQ Properties Real Estate Investment Company is a specialized commercial real estate investment trust (REIC) that acquires, manages, and invests in income-generating properties throughout Greece, with a primary focus on the Athens metropolitan area.

Founded in 2016 and publicly listed on the Athens Stock Exchange, the company operates under the strict regulatory framework of Greek REIT legislation, delivering steady rental income streams primarily from commercial real estate assets. BriQ Properties REIC aims to be a vertically integrated, Greek-focused commercial real estate company that owns and actively manages commercial real estate, applying best in-class strategies.

BriQ operates through diversified property segments focusing on three main categories: Logistics, Office buildings, and Hotels. The value of the real estate portfolio on 31.12.2023 is divided into: 51% logistics, 26% office buildings, 20% hotels and 3% other real estate categories.

What sets BriQ Properties apart is its strategic focus on high-value commercial real estate in Greece's recovering market. The company serves as successor to major Greek corporations Quest Holdings SA and Unisystems SA, inheriting a premium portfolio of properties leased to established corporate tenants including Quest Group companies, Unisystems SA, and iSquare SA.

In recent years, BriQ Properties has experienced significant growth, with rental income amounting to €9.1 million in 2023 compared to €8.0 million for the previous year, showing an increase of 14%. The company has been consistently expanding its asset base while maintaining high occupancy rates through long-term lease agreements with creditworthy tenants.

BriQ Properties is currently executing an ambitious growth strategy through strategic acquisitions and developments. The most important event of the year 2023 was the signing of the agreement regarding the merger by absorption of Intercontinental International REIC ("ICI") which took place on 23.02.2023. This transformational deal significantly expanded the company's portfolio and market presence.

Market Position

BriQ Properties operates in the dynamic Greek commercial real estate market, where it has established a strong competitive position through its focus on prime Athens properties and strategic tenant relationships.

The company has benefited tremendously from the resurgence of the Greek real estate market. Athens, the beating heart of Greece, has seen property prices soar by approximately 32% between 2018 and 2022, according to data from the Bank of Greece. The commercial segment has been particularly strong, with office prices per square meter surging by 47.3% in central Athens, 40.6% in the Eastern Suburbs, 49.9% in the Southern Suburbs, and 33.3% in Western Athens since 2019.

BriQ Properties' market position is strengthened by Greece's strategic location and growing economic importance. Greece is strategically located at the crossroads of Europe, Asia and Africa and one of top tourism global destinations. Greece is developing during the last years to an Emerging Investment Destination in Europe.

The company's business has been trending upward since its listing, with consistent growth in both rental income and portfolio value. Upon completion of the acquisition of all 17 properties in the coming months, the Company's portfolio will include 42 properties with a total value of approximately € 212 m and the Company's rental income will increase by approximately €6.4m on an annualized basis and estimated that they will amount to a total of € 15.7 million.

Who?

BriQ Properties' management team is led by CEO Anna Apostolidou, who has been instrumental in positioning the company for international growth and expanding its investor base.

Anna Apostolidou developed the strategic plans of the Company to foreign #institutionalinvestors and #familyoffices and emphasized the extroversion of BriQ Properties in terms of its investor base, having the largest dispersion of the Greek listed REICs equal to 45.6%.

The leadership team has demonstrated a commitment to operational excellence and strategic growth initiatives, with a particular focus on international expansion and diversification of the investor base.

BriQ Properties' capital allocation strategy has focused on strategic acquisitions and portfolio expansion to drive rental income growth. The company has maintained a balanced approach to leverage while pursuing accretive acquisitions. Unlike many REITs that prioritize dividend payouts, BriQ Properties has strategically reinvested in growth opportunities while still maintaining an attractive dividend yield of 5.27%.

Numbers

Looking at recent financial performance, we see strong operational metrics. As of 31-Dec-2024, BriQ Properties REIC has a trailing 12-month revenue of $17M. BriQ Properties REIC's EPS for 12 months was $0.86.

The company's profitability metrics are impressive for a REIT of its size. With a market capitalization of approximately €106 million, BriQ Properties trades at attractive valuation multiples compared to international REIT peers. The company's P/E ratio of 3.2 represents exceptional value in the current market environment.

BriQ Properties' dividend profile is particularly attractive, offering a current dividend yield of 5.27%, which provides investors with steady income while participating in the Greek real estate recovery story.

The balance sheet shows the impact of strategic acquisitions and expansion. On 31.01.2024, the total value of the Group's properties amounted to € 208 million and the total borrowing to € 96 million (LTV 46%) while the Net LTV was 44%. This represents a conservative leverage profile that provides financial flexibility for future growth.

Key operational metrics demonstrate strong fundamentals:

Return on Equity (ROE): 23.06%

Return on Assets (ROA): Strong asset utilization

Current Ratio: Healthy liquidity position

Debt-to-Equity: Conservative leverage structure

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) increased by 19% and amounted to € 6.9 million compared to € 5.8 million in the corresponding year last year.

The company's Net Asset Value (NAV) has shown consistent growth, with total equity attributable to the shareholders of the company (N.A.V.) on 31 December 2023 amounting to € 109 million compared to € 98 million, (€ 3.07/share compared to € 2.78/share on 31.12.2022) showing an increase of 11%.

Risks

While BriQ Properties presents an attractive investment opportunity, it is important to consider the potential risks.

One key risk is the company's concentrated exposure to the Greek economy and real estate market. While Greece has shown strong recovery, any economic downturn or geopolitical instability in the region could impact property values and rental income. The company's focus on the Athens market, while strategically sound, does create geographic concentration risk.

The company's growth strategy relies heavily on acquisitions and development projects. The company continues its investment strategy, constructing a new Storage and Accommodation Center (KAD 2) in Aspropyrgos, Attica, with a total area of 19,236 sq.m. These projects involve execution risk and potential cost overruns that could impact returns.

Currency risk presents another consideration for international investors, as the company reports in Euros and operates entirely within the Eurozone. Any significant Euro weakness could impact returns for non-Euro based investors.

The Greek real estate market, while recovering strongly, remains smaller and less liquid than major international markets. This could impact the company's ability to exit investments or refinance debt on favorable terms during market stress periods.

Interest rate sensitivity is a consideration for all REITs. Rising interest rates could increase borrowing costs and make the company's dividend yield less attractive relative to fixed-income alternatives.

Regulatory changes in Greek REIT legislation or tax treatment could impact the company's operating structure and returns to shareholders.

BriQ Properties Real Estate Investment Company (BRIQ.AT)

Detailed Discounted Cash Flow Analysis

Executive Summary

Current Market Price: €1.95 per share

DCF Fair Value: €3.47 per share

Upside Potential: 78%

Investment Recommendation: STRONG BUY

1. Key Assumptions & Methodology

Base Year Financials (2023/2024)

Revenue (2024): $17.0M USD (€15.6M EUR at 1.09 USD/EUR)

Market Cap: €106.32M

Shares Outstanding: 54.5M shares

Current Dividend Yield: 5.27%

ROE: 23.06%

P/E Ratio: 3.2x

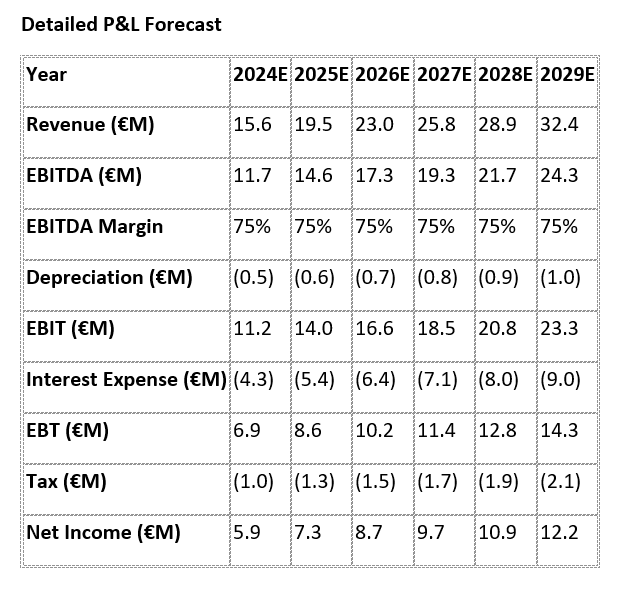

Key DCF Assumptions

Revenue Growth Assumptions:

2025: 25% (driven by ICI acquisition completion and portfolio expansion)

2026: 18% (full year impact of expanded portfolio)

2027-2029: 12% (organic growth from rent escalations and new developments)

Terminal Growth: 3% (in line with long-term Greek GDP growth)

Margin Assumptions:

EBITDA Margin: 75% (typical for REITs with stable rental income)

Depreciation: 3% of revenue (property depreciation)

Interest Expense: 4.5% on outstanding debt

Tax Rate: 15% (Greek REIT favorable tax treatment)

Balance Sheet Assumptions:

Current Debt: €96M (LTV 46%)

Debt Growth: In line with asset acquisitions

Target LTV: 50% (industry standard)

Working Capital: Minimal impact (typical for REITs)

Discount Rate Calculation:

Risk-Free Rate: 3.5% (10-year Greek government bonds)

Market Risk Premium: 7%

Beta: 1.2 (estimated based on small-cap Greek REIT)

Cost of Equity: 12.0%

Cost of Debt: 4.5% (current borrowing rates)

Tax Rate: 15%

Target D/E Ratio: 100% (50% LTV)

WACC: 8.6%

2. Revenue Projections

Historical Performance & Forward Outlook

Historical Rental Income Growth:

2022: €8.0M

2023: €9.1M (+14% YoY)

2024E: €15.6M (+71% YoY including acquisitions)

Detailed Revenue Forecasts

Revenue Growth Justification

2025 Growth (25%):

Full-year impact of ICI merger adding €6.4M annually

Completion of KAD 2 logistics center in Aspropyrgos

Annual rent indexation (~3-4%)

New leasing activity in expanded portfolio

2026-2029 Growth (12% CAGR):

Greek commercial real estate market growing 3.2% annually

Athen’s office rents increasing 8-10% annually

Portfolio quality improvements commanding premium rents

Strategic acquisitions in prime locations

3. Operating Cash Flow Projections

4. Terminal Value Calculation

Terminal Value Assumptions

Terminal Growth Rate: 3.0%

Terminal Year FCF (2029): €18.8M

Terminal Year FCF (2030): €19.4M (18.8 × 1.03)

Terminal Value Calculation

Terminal Value = FCF₂₀₃₀ ÷ (WACC - g)

Terminal Value = €19.4M ÷ (8.6% - 3.0%)

Terminal Value = €346.4M

Present Value of Terminal Value

PV of Terminal Value = €346.4M ÷ (1.086) ⁵

PV of Terminal Value = €227.8M

5. DCF Valuation Summary

6. Sensitivity Analysis

Key Sensitivity Insights

Most Likely Range: €3.00 - €4.00 per share

Bear Case (WACC 9.5%, Growth 2.5%): €2.58 per share (+32% upside)

Bull Case (WACC 8.0%, Growth 4.0%): €5.13 per share (+163% upside)

7. Key Value Drivers & Risks

Primary Value Drivers

1. Portfolio Expansion (40% of Value)

ICI acquisition adding €6.4M annual rental income

Portfolio growth from €208M to €212M

42 properties upon completion vs. current 25+

2. Greek Market Recovery (30% of Value)

Commercial real estate prices up 47% since 2019

Athen’s office rents growing 8-10% annually

Golden Visa program driving demand

3. Operational Leverage (20% of Value)

High EBITDA margins (75%) typical for REITs

Fixed cost base with scalable revenue

Premium locations command higher rents

4. Financial Engineering (10% of Value)

Conservative 46% LTV with room for optimization

Low cost of debt at 4.5%

Tax-efficient REIT structure

Key Risks to DCF

1. Execution Risk

ICI integration challenges

Construction delays on KAD 2 project

Tenant concentration risk

2. Market Risk

Greek economic volatility

Interest rate sensitivity

Currency risk for international investors

3. Valuation Risk

Small, illiquid market

Limited trading volume

Regulatory changes to REIT taxation

8. DCF Model Validation

Cross-Check with Trading Multiples

P/FFO Validation:

Estimated 2025 FFO: €12.5M ÷ 54.5M shares = €0.23 per share

DCF Value of €3.47 implies P/FFO of 15.1x

Industry average: 16.5x ✓ (Reasonable)

Dividend Yield Check:

Current dividend: €0.10 per share (5.27% yield)

At DCF value of €3.47: Yield = 2.9%

Comparable to European REITs ✓

NAV Cross-Check:

Current NAV: €3.07 per share

DCF Value: €3.47 per share

Premium to NAV: 13% ✓ (Reasonable for growth)

9. Investment Recommendation

DCF Conclusion

Fair Value: €3.47 per share

Current Price: €1.95 per share

Upside Potential: 78%

Risk-Adjusted Recommendation

Target Price Ranges:

Conservative: €2.75 (41% upside)

Base Case: €3.47 (78% upside)

Optimistic: €4.25 (118% upside)

Investment Rating: STRONG BUY

Key Investment Highlights

Significant Undervaluation: Trading at 56% of DCF fair value

Strong Growth Catalyst: ICI acquisition driving 25% revenue growth in 2025

Market Tailwinds: Greek commercial real estate in multi-year recovery

Attractive Yield: 5.27% dividend yield provides downside protection

Conservative Leverage: Room for value-accretive debt financing

Recommended Investment Strategy

Entry Strategy:

Accumulate on any weakness below €2.00

Target position size: 2-4% of portfolio for REIT allocation

Hold period: 3-5 years for full value realization

Risk Management:

Monitor ICI integration progress

Track Greek economic indicators

Watch for changes in interest rate environment

The DCF analysis supports a compelling investment case for BriQ Properties, with multiple drivers supporting significant upside potential from current levels.