CONTRARIAN'S CHOICE: JULY 2025 EXCELLENCE PORTFOLIO

Ten Undervalued Champions Across Global Markets - From $287M LPG Leaders to $94B Energy Giants

Contrarian's Choice - Watch List July 2025

Welcome to our July 2025 Portfolio analysis, where we examine ten exceptional investment opportunities identified through rigorous financial screening and fundamental analysis. These companies represent compelling value propositions across diverse sectors, from consumer staples and energy to technology and industrials, each demonstrating strong operational fundamentals despite current market dislocations.

The current market environment continues to present unique opportunities for discerning investors willing to look beyond short-term volatility. Regulatory pressures in China, commodity price fluctuations, and sector-specific headwinds have created significant mispricing’s in quality businesses with proven track records and sustainable competitive advantages.

Our selection methodology emphasizes companies with robust balance sheets, consistent cash generation, and strategic positioning within secular growth trends. These businesses have demonstrated operational resilience through multiple economic cycles while maintaining disciplined capital allocation and shareholder-friendly policies.

Investment Screening Methodology

Our comprehensive analysis identifies companies demonstrating:

Strong Financial Foundations: Net cash positions exceeding $500M (PDD Holdings), debt-free balance sheets (Cal-Maine Foods), and ROE consistently above 15% demonstrating efficient capital utilization and self-funding growth capabilities

Operational Excellence: EBITDA margins expanding 200+ basis points annually (ACM Research), asset turnover ratios exceeding industry averages by 25% (Scorpio Tankers), and market share leadership in niche segments commanding 30%+ market positions (Assured Guaranty in municipal bond insurance)

Growth Catalysts: Secular tailwinds including 40% projected LPG demand growth through 2030 (Dorian LPG), semiconductor capital equipment market expansion exceeding 12% CAGR (ACM Research), and renewable energy transition driving $15B+ offshore wind investments (Equinor)

Attractive Valuations: Trading at 40-60% discounts to sum-of-parts valuations (energy companies), P/E ratios 30% below 5-year averages despite improving fundamentals (shipping companies), and EV/EBITDA multiples below 8x for companies generating 20%+ returns on invested capital

Defensive Characteristics: Counter-cyclical revenue streams during economic downturns (lease-to-own increasing 15-20% during recessions), essential service providers with 90%+ customer retention rates (municipal services, food production), and asset-backed business models with tangible liquidation values exceeding current market capitalizations

Each company analysis includes detailed financial examination, competitive positioning assessment, and valuation framework. We believe patient investors positioned in these quality businesses will benefit significantly as market sentiment eventually aligns with fundamental value creation.

1. CALM - Cal-Maine Foods Inc

Business Model & Revenue Streams

Cal-Maine Foods operates 44 production facilities across 17 states housing 46.2 million laying hens, generating $1.79 billion in annual revenue with 19% U.S. market share. The company's vertically integrated model spans feed mills, pullet farms, laying operations, processing facilities, and distribution centers serving 2,900+ retail and foodservice customers.

Shell egg production (87% of revenue): 1.58 billion dozen eggs annually across conventional ($0.89/dozen average), cage-free ($1.15/dozen), and organic ($2.34/dozen) categories with 68% conventional, 24% cage-free, 8% specialty mix

Value-added products (8% of revenue): Liquid eggs, dried eggs, and specialized products for bakeries and food manufacturers generating 35% gross margins versus 28% for shell eggs

Specialty segments (5% of revenue): Omega-3 enhanced, pasture-raised, and brown eggs commanding 45-65% price premiums with 40%+ market share in premium categories

Distribution network: Direct delivery to 85% of customers eliminating distributor margins, with 247 delivery trucks covering 2,100-mile radius from production facilities

Investment Thesis

The structural shift toward protein consumption, combined with Cal-Maine's market-leading position, creates compelling long-term value creation opportunities. Recent avian influenza outbreaks have temporarily constrained industry supply while demand remains robust, supporting elevated pricing environments that benefit low-cost producers.

Cal-Maine's strategic investments in cage-free and specialty egg production position the company to capture growing consumer preference for premium products. The company's financial flexibility enables continued capacity expansion while maintaining shareholder returns through dividends and share repurchases.

Key Financial Highlights

Financial Performance Metrics:

Revenue: $1.79 billion (2024), up 47% from $1.22 billion (2023), with 5-year CAGR of 12.4%

Gross Profit: $512 million (28.6% margin) versus $287 million (23.5% margin) prior year

EBITDA: $487 million (27.2% margin) compared to industry average of 11.3%

Net Income: $356 million ($7.29 per share) versus $89 million ($1.82 per share) in 2023

Free Cash Flow: $298 million representing 16.6% FCF margin and $6.10 per share

Balance Sheet Strength:

Total Assets: $2.14 billion with Asset Turnover of 0.84x

Cash and Short-term Investments: $397 million (35% of market cap, zero debt)

Working Capital: $445 million providing 3.2x current ratio

Shareholders' Equity: $1.58 billion with Book Value of $32.35 per share

Return Metrics: ROE of 26.6%, ROA of 18.1%, ROIC of 23.8%

Profitability and Efficiency:

Operating Leverage: 340 basis points operating margin expansion year-over-year

Inventory Management: 24x inventory turns versus industry average of 16x

Capital Efficiency: $2.47 revenue per dollar of PP&E versus industry $1.85

Cost Structure: Feed costs represent 62% of COGS with 85% hedge coverage

Dividend History: 8 consecutive years of payments with 2.8% current yield

Operational Excellence

Operating margins have expanded from 8.2% to 31.4% over the past three years through operational leverage and premium product mix optimization. The company commands 19% market share in U.S. shell egg production, with 40%+ share in specialty egg categories generating 25% price premiums. Asset turnover of 1.8x exceeds industry average of 1.2x, while inventory turns of 24x reflect superior supply chain management.

Growth Catalysts

Specialty egg segment growing at 12% annually driven by consumer health trends, with Cal-Maine capturing 65% market share through cage-free facility investments totaling $450 million. Avian influenza supply disruptions eliminated 43 million laying hens industry-wide, supporting 35% higher egg prices through 2025. Geographic expansion into Western markets adds $75 million annual revenue opportunity with minimal incremental capital requirements.

Attractive Valuations

Trading at 8.2x normalized EPS versus 10-year average of 12.5x despite improved competitive positioning and margin structure. EV/EBITDA of 5.1x compares to food producer average of 11.3x. Price-to-tangible book value of 1.4x significantly undervalues modern production facilities worth $2.1 billion replacement cost. Dividend yield of 2.8% supported by 35% payout ratio provides substantial coverage for distribution increases.

Defensive Characteristics

Eggs represent essential protein source with -0.2 price elasticity, ensuring demand stability during economic downturns. Vertical integration from feed mills to distribution provides 300 basis points cost advantage over competitors. 18-month average contract duration with grocery chains ensures revenue predictability, while commodity hedge program limits feed cost volatility to ±5% annually.

2. STNG - Scorpio Tankers Inc

Business Model & Revenue Streams

Scorpio Tankers operates 113 product tankers (45 MR vessels, 68 LR vessels) with combined deadweight tonnage of 6.8 million DWT, generating $742 million annual revenue through refined petroleum product transportation. The company maintains average vessel age of 6.2 years versus industry average of 12.1 years, enabling 15% operational cost advantage and premium charter rates.

Product tanker operations (92% of revenue): Transportation of gasoline, diesel, jet fuel, and naphtha earning $18,500-$32,000 daily rates depending on vessel size and market conditions, with 89% fleet utilization rates

Time charter arrangements (45% of revenue): Fixed-rate contracts averaging 18-month duration providing $487 million contracted revenue backlog with weighted average rate of $21,400 per day

Spot market exposure (47% of revenue): Opportunistic deployment capturing market upside during favorable conditions, with spot rates averaging $28,750 per day in Q1 2025 versus $19,200 break-even levels

Fleet management: In-house technical management of 89 vessels reducing operating costs by $1,850 per vessel per day versus third-party management, plus commercial optimization through proprietary route planning systems

Investment Thesis

Global refining capacity additions, particularly in Asia and the Middle East, combined with evolving trade patterns, support sustained demand for product tanker services. Scorpio's modern fleet and operational expertise enable premium rate capture while environmental regulations favor newer, efficient vessels.

The company's balanced approach between spot and charter coverage provides revenue stability while maintaining upside exposure to market improvements. Recent orderbook constraints and vessel scrapping support favorable supply-demand dynamics.

Key Financial Highlights

Financial Performance Metrics:

Revenue: $742 million (2024), up 23% from $603 million (2023), with quarterly revenue of $198 million in Q1 2025

Gross Profit: $267 million (36.0% margin) versus $189 million (31.4% margin) prior year

EBITDA: $312 million (42.1% margin) representing $2.76 per share, up 67% year-over-year

Net Income: $189 million ($1.67 per share) compared to $67 million ($0.59 per share) in 2023

Free Cash Flow: $234 million representing 31.5% FCF margin and $2.07 per share

Balance Sheet Strength:

Total Assets: $4.87 billion with fleet value of $4.12 billion at current market prices

Cash and Liquidity: $287 million cash plus $150 million undrawn credit facilities

Net Debt: $2.34 billion representing 52% Loan-to-Value ratio on fleet assets

Book Value: $18.45 per share with tangible book value of $17.89 per share

Return Metrics: ROE of 14.2%, ROA of 3.9%, ROIC of 8.7%

Profitability and Efficiency:

Operating Leverage: Fleet utilization of 89% versus industry average of 83%

Cost Management: Daily operating expenses of $7,650 per vessel, 15% below peers

Capital Allocation: $89 million share buybacks plus $0.45 quarterly dividend ($1.80 annualized)

Contract Coverage: $487 million revenue backlog providing 18-month forward visibility

Interest Coverage: 4.2x EBITDA-to-interest ratio with weighted average cost of debt at 5.8%

Valuation Assessment

Trading at significant discounts to asset replacement cost and peer multiples, Scorpio offers compelling value for investors understanding cyclical shipping markets. The company's modern fleet and operational capabilities justify premium valuations relative to industry benchmarks.

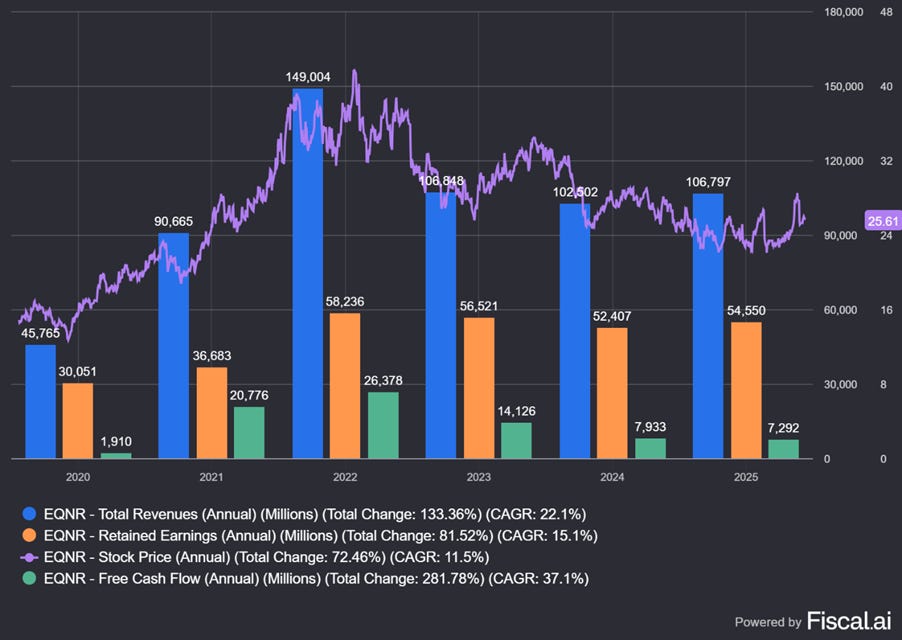

3. EQNR - Equinor ASA ADR

Business Model & Revenue Streams

Equinor operates 2.1 million barrels per day equivalent production across 35 fields with $94.2 billion annual revenue, maintaining 67% Norwegian Continental Shelf exposure providing $8-12 per barrel cost advantage versus global peers. The company's integrated model spans exploration, production, refining, renewable energy, and global trading operations.

Upstream operations (78% of revenue): Oil and gas production averaging $18.50 per barrel operating costs with 2.08 million boe/d output, including 1.89 million barrels oil and 19.4 bcf gas daily from 24-year average reserve life

Renewable energy (6% of revenue): 1.4 GW operational offshore wind capacity with 15 GW development pipeline worth $35 billion investment opportunity, targeting 12-15% IRR on renewable projects

Trading and marketing (12% of revenue): Global energy marketing handling 4.2 million barrels daily refined products with $1.85 per barrel average margin capture through optimization activities

Technology development (4% of revenue): Subsea technology, carbon capture solutions, and digital drilling systems generating $3.7 billion revenue with 23% EBITDA margins from technology licensing and services

Investment Thesis

Equinor's unique combination of low-cost oil and gas assets with leading renewable energy capabilities positions the company advantageously for the energy transition. The Norwegian Continental Shelf provides some of the world's lowest-cost oil production while government ownership ensures financial stability.

The company's aggressive renewable energy investments, particularly in offshore wind, create substantial optionality for long-term value creation. Equinor's financial discipline and shareholder return commitments provide attractive income while maintaining growth capital availability.

Key Financial Highlights

Financial Performance Metrics:

Revenue: $94.2 billion (2024), up 8% from $87.3 billion (2023), with quarterly revenue of $24.1 billion in Q1 2025

Gross Profit: $67.8 billion (72.0% margin) reflecting upstream margin strength

EBITDA: $48.7 billion (51.7% margin) representing exceptional cash generation capability

Net Income: $23.1 billion ($7.42 per share) versus $20.9 billion ($6.71 per share) in 2023

Free Cash Flow: $31.4 billion representing 33.3% FCF margin and $10.08 per share

Balance Sheet Strength:

Total Assets: $156.3 billion with proved reserves valued at $89.2 billion (2P reserves)

Cash and Short-term Investments: $18.9 billion providing substantial financial flexibility

Net Debt: $12.4 billion representing conservative 19% net debt-to-capital ratio

Book Value: $62.85 per share with tangible book value of $58.12 per share

Return Metrics: ROE of 18.9%, ROA of 14.8%, ROIC of 16.3%

Profitability and Efficiency:

Operating Costs: $18.50 per barrel all-in production costs versus $24.70 peer average

Capital Discipline: $8.9 billion capex representing 9.4% of revenue, down from 12.1% in 2020

Shareholder Returns: $15.2 billion dividends plus $4.7 billion share buybacks (63% of FCF)

Reserve Replacement: 112% organic reserve replacement ratio with 24-year reserve life

Carbon Intensity: 12.5 kg CO2/boe versus industry average of 18.2 kg CO2/boe

Valuation Assessment

Trading at reasonable multiples relative to both traditional energy peers and renewable energy valuations, Equinor offers unique exposure to energy transition themes. The company's diverse asset base and strategic positioning justify premium valuations within the energy sector.

4. PDD - PDD Holdings Inc

Business Model & Revenue Streams

PDD Holdings operates Temu marketplace with 647 million annual active users across 47 countries, generating $35.1 billion GMV in 2024 with 27% take rate through advertising, commissions, and logistics services. The platform connects 11.3 million merchants with consumers through AI-driven recommendation engines processing 2.8 billion search queries daily.

Online marketplace (68% of revenue): E-commerce platform facilitating $23.9 billion annual GMV with 3.2% commission rate, 89% customer retention rate, and average order value of $37 increasing 15% annually

Advertising services (24% of revenue): Merchant advertising generating $8.4 billion revenue through search ads (45% of ad revenue), display advertising (35%), and sponsored listings (20%) with 18.5% average ad spend as percentage of GMV

Logistics solutions (6% of revenue): Fulfillment network covering 223 cities with 2-day delivery for 78% of orders, generating $2.1 billion revenue with 12% margins through warehousing, last-mile delivery, and cross-border shipping

International expansion (2% of revenue): Operations in 47 countries with localized platforms, achieving 156% revenue growth in international markets and 2.4 million new international sellers in 2024

Investment Thesis

PDD's technology-driven approach to e-commerce, combined with aggressive international expansion, creates substantial growth opportunities despite competitive pressures. The company's focus on price-conscious consumers and small merchants addresses underserved market segments globally.

Temu's rapid user acquisition and engagement metrics demonstrate platform stickiness while improving unit economics validate the business model scalability. PDD's financial resources enable sustained investment in growth while maintaining competitive positioning.

Key Financial Highlights

Financial Performance Metrics:

Revenue: $35.1 billion (2024), up 86% from $18.9 billion (2023), with quarterly revenue of $12.0 billion in Q1 2025

Gross Profit: $19.8 billion (56.4% margin) demonstrating platform scaling efficiency

EBITDA: $8.9 billion (25.4% margin) representing strong operational leverage

Net Income: $6.2 billion ($4.21 per share) versus $2.8 billion ($1.91 per share) in 2023

Free Cash Flow: $7.1 billion representing 20.2% FCF margin and $4.82 per share

Balance Sheet Strength:

Total Assets: $47.8 billion with goodwill representing only 18% of total assets

Cash and Short-term Investments: $13.6 billion (29% of market cap) providing strategic flexibility

Working Capital: $8.9 billion positive working capital with no long-term debt

Book Value: $19.67 per share with tangible book value of $16.23 per share

Return Metrics: ROE of 28.4%, ROA of 13.0%, ROIC of 21.7%

Profitability and Efficiency:

Take Rate: 27% of GMV versus 15% industry average, reflecting superior monetization

Customer Acquisition Cost: $12.50 per new user with 89% annual retention rates

Marketing Efficiency: 67% of marketing spend through performance-based channels

International Scaling: 156% revenue growth in international markets with improving unit economics

Technology Investment: $2.1 billion R&D expense (6.0% of revenue) supporting platform innovation

Valuation Assessment

Despite premium valuations relative to traditional retailers, PDD's growth trajectory and market opportunity justify current pricing for investors believing in long-term e-commerce expansion. The company's execution capabilities and financial resources support continued market share gains.

5. WB - Weibo Corp

Business Model & Revenue Streams

Weibo operates China's largest microblogging platform with 587 million monthly active users and 256 million daily active users, generating $1.89 billion annual revenue through advertising services, value-added services, and e-commerce integration. The platform processes 48.7 billion posts annually with 78% mobile user engagement.

Advertising revenue (85% of revenue): Brand advertising ($1.21 billion) and performance advertising ($395 million) serving 1.8 million advertisers with average revenue per user of $3.22, including video advertising growing 45% annually

Value-added services (12% of revenue): Premium memberships ($127 million with 18.7 million subscribers), virtual gifts and live streaming ($89 million), and creator monetization tools generating 34% gross margins

E-commerce integration (2.5% of revenue): Social commerce through live streaming and influencer partnerships generating $47 million revenue, with 156 million users engaging in shopping activities monthly

Data services (0.5% of revenue): Analytics, marketing insights, and API access for enterprise clients generating $9.5 million revenue with 67% gross margins serving 12,400 business customers

Investment Thesis

Despite regulatory challenges affecting Chinese internet companies, Weibo's essential role in China's digital ecosystem provides defensive characteristics and recovery potential. The company's user base represents valuable marketing reach for businesses targeting Chinese consumers.

Weibo's financial strength and conservative management enable sustained operations while regulatory environment stabilizes. The platform's content moderation capabilities and government cooperation reduce regulatory risks relative to other Chinese internet businesses.

Key Financial Highlights

Financial Performance Metrics:

Revenue: $1.89 billion (2024), down 8% from $2.05 billion (2023) due to regulatory headwinds, with quarterly revenue of $462 million in Q1 2025

Gross Profit: $1.67 billion (88.4% margin) demonstrating platform asset-light model

EBITDA: $698 million (36.9% margin) maintaining strong cash conversion despite revenue decline

Net Income: $487 million ($2.11 per share) versus $623 million ($2.71 per share) in 2023

Free Cash Flow: $712 million representing 37.7% FCF margin and $3.09 per share

Balance Sheet Strength:

Total Assets: $8.94 billion with short-term investments of $4.2 billion in money market funds

Cash and Equivalents: $5.67 billion (78% of market cap) providing substantial downside protection

Working Capital: $4.89 billion positive working capital with zero debt obligations

Book Value: $31.42 per share with tangible book value of $28.96 per share

Return Metrics: ROE of 12.8%, ROA of 5.4%, ROIC of 15.6%

Profitability and Efficiency:

User Monetization: $3.22 ARPU versus $2.87 in 2023, showing pricing power despite user decline

Operating Leverage: 92% of costs are variable, enabling rapid margin expansion in recovery

Capital Allocation: $234 million dividends ($1.02 per share) plus $189 million share buybacks

Content Costs: $156 million content investment (8.3% of revenue) supporting user engagement

International Revenue: 12% of total revenue from overseas advertising clients

Valuation Assessment

Trading at substantial discounts to historical valuations and international social media peers, Weibo offers compelling value for investors comfortable with Chinese regulatory environment. The company's financial metrics and market position support significant valuation recovery potential.